[draft work in progress. Copyright Earl H. Nemser @ 6/1/20] The Insurance Industry and COVID-19 Claims–How a Disintermediated Solution Can Sustain a Socially Essential Industry and Adequately Compensate Policyholders By Eliminating Unnecessary Middlemen (This Case Study Is Not Funded.)

Syllabus: This Case Study examines the development of the global controversy over whether Business Interruption Insurance Policies cover the tragic losses suffered by thousands of businesses around the world as a result of the COVID-19 Pandemic. The study approaches the issues without any bias other than in favor of a Disintermediated Solution that would lead to a favorable conclusion for the real parties in interest. It will discuss three competing factions that are aligned in some respects, but each with somewhat different financial interests.

Policyholders: This faction includes the businesses that paid insurance premiums for years and may now find that the language of their Business Interruption Insurance Policies, which they comfortably put away and “relied” on, but likely never read or understood, may not cover their COVID-19 losses. The Policyholders are the most important parties, but they do not always have independent champions to educate them and to protect their interests. They are ordinarily not professionally equipped to navigate the complex legal process and as currently structured, it may likely fail many of them and leave bankruptcy as their most reasonable option.

Middlemen: This faction includes a small, but vocal breed of lawyers and the Litigation Finance Industry regularly engaged in the business of Big Ticket Litigation. This faction can be important to help Policyholders understand their rights, and to level the playing field when they are in disputes with dominant business interests. The stated mission of some in this faction is to “exploit the opportunities generated by crisis.” As such, it can agitate matters, create tensions, escalate disputes and make them more expensive than necessary. Some lawyers (who are not representative of the legal profession generally) unfortunately thrive in this environment. This faction is not a real party in interest. It is burdened with conflicts of interest that may compromise judgment and disadvantage Policyholders instead of providing them with practical outcomes consistent with their best interests.

Insurance Industry: This is the other important faction. It sold insurance policies with the good intention of removing uncertainty and protecting their Policyholders from calamities by spreading risk across society so none must suffer inordinately. The industry must deal with the unprecedented COVID-19 losses that were unanticipated, and not accounted for in the premiums it charged, while retaining adequate reserves for unrelated perils. It must grapple with the problems created by insurance policy language written by underwriters, some of whom, it has been argued, lacked foresight and linguistic skills.

The real parties in interest, the Insurance Industry and the Policyholders, in many respects are ordinarily “partners” of sorts. Their shared interests include minimizing losses and spreading them through broad elements of society, so none suffer inordinately. Their financial fortunes are in many respects aligned. Policyholders want financially healthy insurers as their safety nets and the Insurance Industry wants stable Policyholders to pay premiums that may be used to compensate those who suffer losses. In all circumstances, it is optimal for the real parties in interest to work in harmony and solve claim disputes among themselves. Perhaps that is why Chubb, an industry leader, embraces this motto: “If a solution is possible, we’ll find a way to make it happen.”

Against the backdrop of the COVID-19 Pandemic, this study will demonstrate how the Middlemen faction can be gently set aside to permit the real parties in interest to use simple tools to create a Disintermediated Solution so that they can realize an optimal financial outcome. Disintermediation means removal of intermediaries from the supply chain—in plain words: “eliminate the middlemen.” It is successfully implemented in most areas of our everyday life, as Amazon disintermediated the retail industry by eliminating the stores. Disintermediation can be deployed in the COVID-19 Insurance Litigation to resolve it on a timely and efficient basis allowing the Policyholders to get on with their business, and the Insurance Industry to focus on its socially desirable mission: protecting their Policyholders by spreading the risk of catastrophic events.

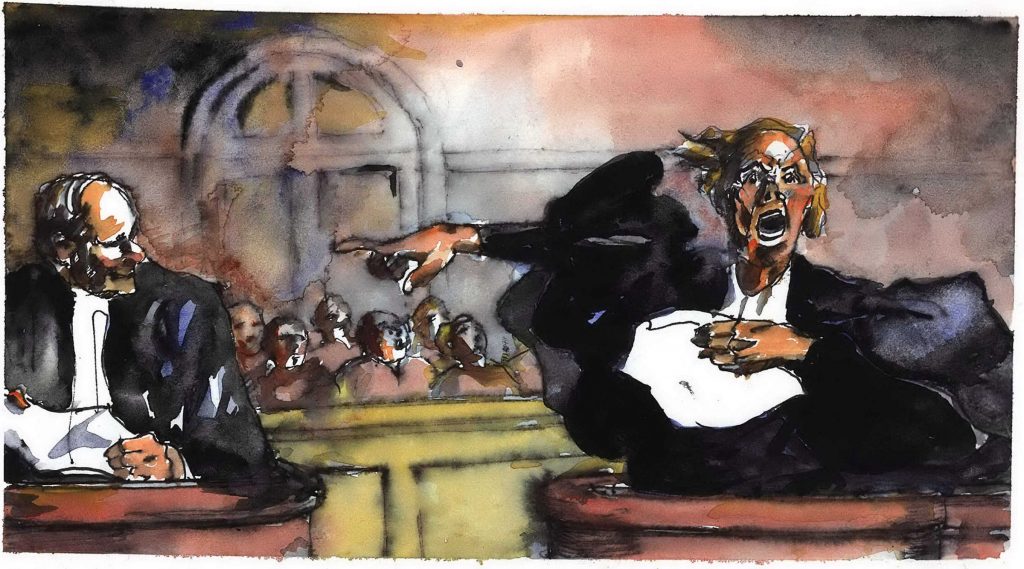

In the course of developing a Disintermediated Solution, this study will review the Insurance Industry’s initial, very proper and sympathetic response to the “coverage crisis,” and then explore how the industry ”took the bait” cast widely by the lawyers and other Middlemen, who tend to agitate. The Insurance Industry permitted the controversy to escalate as it banded together on a course committed to fight back “tooth and nail.” The discussion addresses how this unnecessary litigation brawl can continue to unravel and take unanticipated turns; and whether this could ultimately present a serious threat to the Insurance Industry’s performance of its essential role that protects Policyholders and is intimately tied to the public interest.

The study will review details of the current COVID-19 Insurance Litigation in plain language, including the major elements of the dispute, the law as it relates to the actual insurance policy language. At the outset the language seemed to clearly favor the Insurance Industry, backed by a long history of case law, but later it became open to question. It will examine the four important words common in Business Interruption Insurance Policies: “Physical Loss or Damage” which is required to trigger coverage. It will then discuss how the dispute might play out in the traditional legal process, and why this theatre should be avoided.

After doing so, this study observes that the Middlemen appear to entice Policyholders into suing the Insurance Industry in Aggregated Cases, like class actions, that combine groups of claims, to increase the Middlemen’s “take”, without corresponding incremental effort or expense. Some of these Middlemen appear to operate inconsistently with the interests of the Policyholders who would be significantly better off rejecting the opportunity to be part of an Aggregated Case, and instead, just sitting tight, protected by what are called “Tolling Agreements”, observing test cases from the sidelines and avoiding legal costs entirely.

This study will conclude by offering a practical blueprint for a Disintermediated Solution to the COVID-19 Litigation Crisis based on a hypothetical $90,000 case. It will demonstrate how a simple solution can be implemented world-wide to more quickly end the burdensome COVID-19 Insurance Litigation that has turned into its own massive economic plague. Instead of wasting time navigating the painful legal process, and the prospect of courtrooms filled with angry people, the Insurance Industry and the Policyholders can shatter the faded mold and resume their “partnership”, end the Litigation Crisis and realize a better financial result, allowing the Policyholders to spend their time re-building their businesses and exploring a better life, and the Insurance Industry to serve its social purpose without distractions.

A Disintermediated Solution would be implemented by a Summit attended by Insurance Industry leaders and leaders from major trade groups that represent Policyholders from important business segments with COVID-19 related claims. It would be led by an Administrator who is assisted by econometricians who will model various scenarios as well as other professionals.

Part One: The Disputes About Insurance Payments For COVID-19 Losses Began Quietly And Could Have Been Controlled.

Soon after the COVID-19 Pandemic “lock-downs” began in California on March 19, 2020, business owners began making light inquiries about whether their All-Risks Business Interruption Insurance Policies might cover their anticipated losses. Policyholders were facing tragedies of all sorts. The Insurance Industry’s position, while sympathetic towards the Policyholders, understandably discouraged them from making claims based on the then prevailing view of standard policy language and the coverage it afforded.

This is a response